You can’t rating a protected mortgage no mortgage, due to the fact mortgage try linked with your residence. When you have no financial because you has paid it off, you might imagine remortgaging otherwise unsecured fund rather. When you are renting otherwise coping with your mother and father, you could envision a keen unsecured sort of borrowing as an alternative.

When do We think a guaranteed mortgage?

You should only thought a protected mortgage when you have an enthusiastic house so you’re able to safe they facing (just like your home), and you are yes you might see your month-to-month money on time plus complete each month. Plus, bear in mind, if you combine your existing credit, your ount you pay as a whole.

- you really have smaller-than-best credit (when you have poor credit some think it’s simpler to score a protected mortgage than simply a personal bank loan as your asset offsets a few of the exposure on financial)

- you should borrow a great number of bucks (between up to ?ten,100 and you will ?250,000)

- you are prepared to waitthree to help you four weeksor very on the currency ahead due to (since secured personal loans tend to take longer to help you procedure than just personal loans because of the documentation involved)

- you don’t have people coupons you could utilize alternatively

- youre comfortable playing with an asset because security and you’re aware of the risks with it

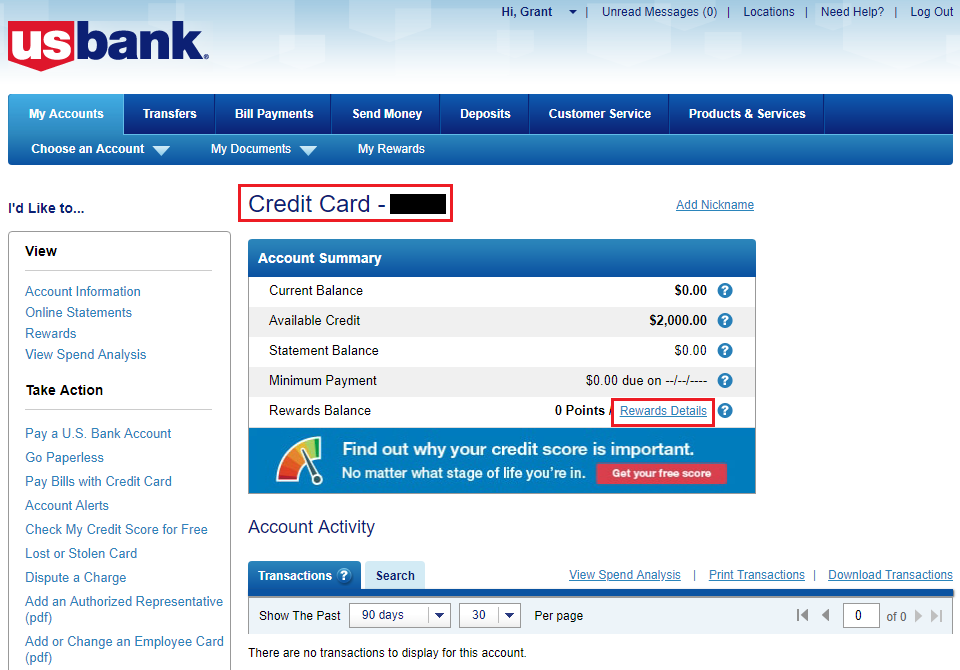

Can i rating a protected loan with no security?

No, you cannot score a secured mortgage no guarantee even if you very own your home and have a mortgage. With sufficient collateral on your own property is a switch dependence on a secured financing, just like the financing is tied to portion of your residence one you own downright.

- a great balance on your own mortgage and you can

- economy worth of your house.

Instance, for those who have a ?one hundred,100000 a great mortgage harmony into the a property well worth ?2 hundred,000, the guarantee is actually ?100,100 (that’s fifty% of one’s newest well worth). The greater number of security you’ve got, the more you are in a position to borrow against they, since the there is reduced chance of you entering negative equity (the place you are obligated to pay more your property is value).

If you are a homeowner rather than i thought about this adequate security, or a renter without property, there are many more types of borrowing you could potentially envision rather – instance a personal loan, credit card otherwise overdraft.

What exactly do loan providers undertake just like the collateral?

In some facts, possible secure financing facing an asset other than a house. Any sort of you will be protecting the loan against has to be rationally able to purchase total cost of one’s mortgage, in the event you can not afford the newest money.

- property here is the most common sorts of security and is sold with domiciles, apartments and sometimes even commercial assets

- auto an effective logbook mortgage are protected up against your car. In the event that are not able to pay the borrowed funds, the lender could legitimately repossess your vehicle. Be aware, this type of financing constantly apply higher interest rates

- deals particular lenders can get deal with savings given that security if they are thorough enough to cover the borrowed funds. Although not, if you have offers, it may make a whole lot more experience to utilize him or her rather than providing away a protected mortgage (since this can save you from inside the interest and you can charge)

Why do specific loans want collateral?

Secured loans want collateral as it provides the financial guarantee that they will be able to allege right back finance in case there is non-fee – while they you’ll repossesses the resource, since a history resort.

That it safety net reduces the chance into bank and you can enables these to give big sums of cash which have down rates than the unsecured loans. But because of the possible chance for the property, it is important that you’re certain you might do brand new repayments toward a resident financing before taking you to aside.