How Are Tx USDA Financing Determined?

Tx USDA Finance try determined according to estimated income calculated of the the lenders towards up coming 12 months. The utmost loan amount calculation is https://paydayloanalabama.com/georgiana/ accomplished based on every readily available historical analysis, and it has the modern pay stubs plus W2s. But not, the fresh new USDA keeps lay their income limitation, and is calculated just before deductions are produced from the newest payroll. Gross income is largely a representation of any incentives, salary, tips, commission, overtime, and even solution compensation; additionally, it may is way of life allowances costs or perhaps the construction allocation gotten.

If you’re contained in this a family in which a member is actually a good farmer or they’ve a business, discover today the employment of net gain off surgery. On top of that, loan providers likewise have their own certain assistance hence revolve to work and earnings.

Every fund is susceptible to underwriting otherwise buyer acceptance. Most other restrictions get use. It is not an offer from credit otherwise a partnership to help you lend. Guidelines and products are subject to alter.

The latest USDA Financing Acceptance Procedure for a good USDA mortgage into the Texas begins with getting in touch with a medication USDA Loan Personal Financial. Acknowledged USDA Mortgage Individual Lenders was backed by the united states Department off Agriculture but do not in fact offer you the home loan on their own.

Exactly what are the Benefits associated with A colorado USDA Financing?

The benefit of a tx USDA Financing gets locked on the a thirty-season mortgage having a minimal fixed interest rate and potentially no advance payment requirements. If you don’t have a down-payment, you are going to need to pay a premium to own mortgage insurance to mitigate the brand new lender’s risk.

Tx USDA mortgage advantages and disadvantages

Secondly, no cash reserves are crucial. This will help to you buy a property less devoid of a lot of money secured on the financial.

The credit and you can being qualified direction was versatile, which also makes it easier so you’re able to be eligible for financing, though your credit score, report, and you can score is while the most useful while they would need end up being getting conventional otherwise commercial money.

Several other brighten in the program would be the fact it can be put up so the supplier will pay new settlement costs. The lack of prepayment penalties and lowest repaired rates is several alot more have you to definitely save a little money. You are able to make use of this mortgage to finance closing costs and repairs straight into the loan.

The overall independency of system is really versatile you are able to use this 1 getting building a property, buying a property, if not merely refinancing one to. The applying support Farming Brands that have Operating Money to assist finance Agriculture Businesses. This type of Performing Loans give guidelines having farmers to view top quality locations.

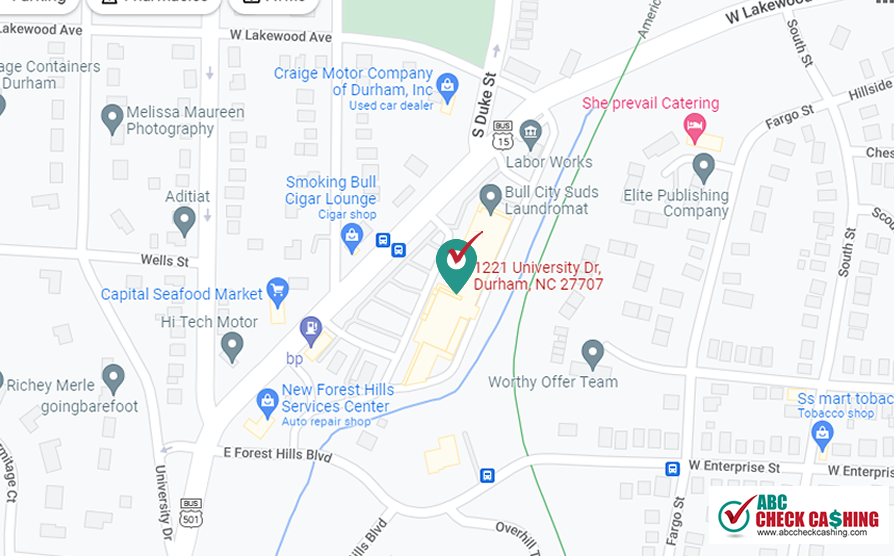

For just one, you can find geographic limits. Even though many Texans meet the criteria on the system, it is oriented more with the outlying and you will suburban residential property, therefore people located in highly towns might not be considered. The good news is, discover online resources where you are able to simply connect from the home address of any house to decide most likely qualification.

Next, you’ll find earnings limits. For individuals who or all your family members helps make excess amount in excess of your system caps, you might not qualify for assistance or experts.

3rd, mortgage insurance policy is constantly as part of the mortgage. At the same time, it’s best that you have that publicity, and really essential to start by. But not, pressed introduction to your financing might stop you from doing your research for your own personal insurer of preference.

Fourth and finally, so it mortgage and system usually do not be eligible for duplex residential property. Appropriate residences can simply getting solitary-family members units. And additionally, they must be holder-filled, so you cannot use these pros to own flips, renting, or travel residential property.