Sensible houses is a hot topic as of late, regardless of if it’s not as misleading having homes value or casing your bulk of an enthusiastic area’s residents are able to afford. Sensible housing, given that defined from the You.S. Agencies of Houses and you can Metropolitan Advancement (HUD), is homes that needs less than 30% regarding an enthusiastic occupant’s terrible month-to-month income.

Why don’t we grab a far more inside the-depth look at how affordable housing work, the different versions it comes inside and exactly how some one can also be meet the requirements for it variety of guidelines.

What’s Reasonable Housing?

I’ve not at all times held an identical conditions for affordable homes. In earlier times, the subject of sensible housing referred to low-money, paid or personal housing. That is due to the fact altered.

Now , the dilemma of reasonable property influences the income peak but the fresh high about U.S. Basically, which definition stretched to include people property which enables residents to help you buy their house near the top of essentials, such as health care or food.

Really HUD homes applications endeavor to help the lowest salary earners, even if. By doing this, low-money some body can perform the dream about homeownership when you’re going for the ability to start racking up riches.

For somebody Otherwise Family unit members

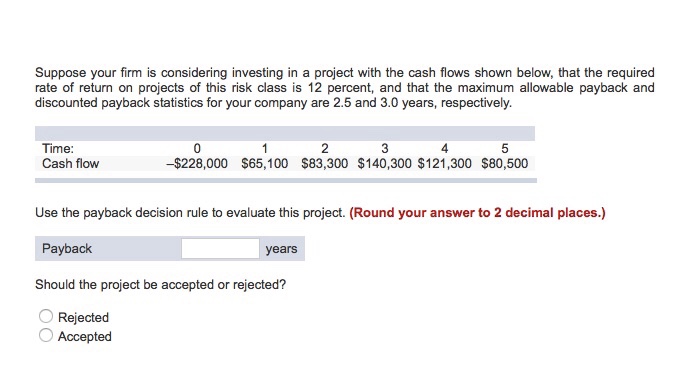

The brand new HUD represent housing cost based on disgusting monthly income. This is actually the full matter your family earns in advance of deductions such taxes otherwise expenditures. Thus, considering HUD, reasonable property for anyone, and additionally tools, do not surpass 29% of these revenues.

To possess A residential area

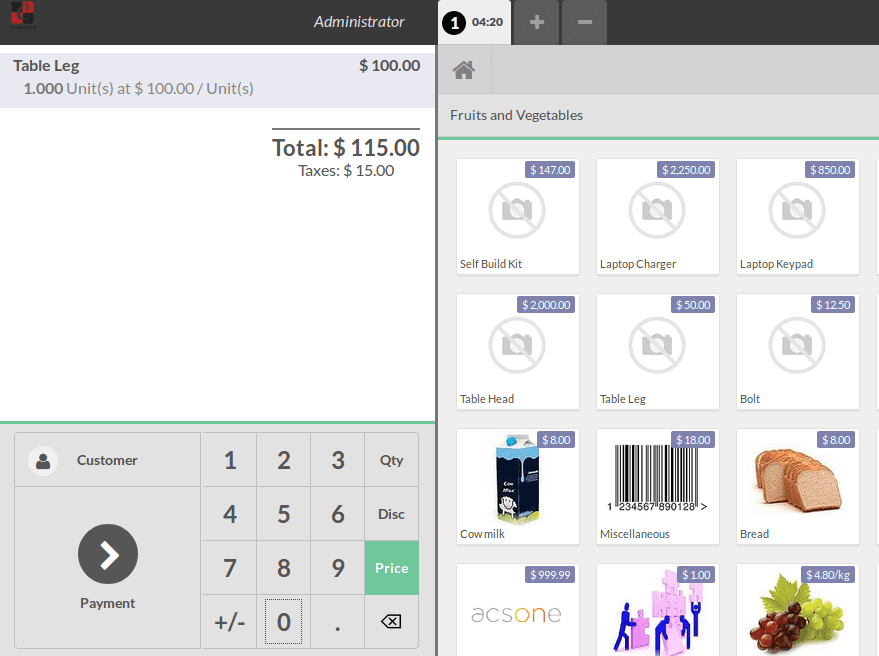

This new HUD spends income constraints whenever choosing qualifications for their programs. Very, for the most part, you could just take part if for example www.paydayloanalabama.com/elmore the money consist within a particular level for your geographic city. However, you should remember that your age or having good bodily handicap may also qualify your having housing advice.

Concurrently, some reasonable housing assistance is relegated to certain elements, such as for instance rural settings. You can also find whole neighborhoods and you will apartment houses which might be lease regulated or promote a mixture of affordable and market-rate casing. Unfortuitously, towns is also experience a decreased instance teams and you may low-money somebody are obligated to relocate otherwise look for almost every other direction solutions.

What are Sensible Construction Earnings Limitations Centered on?

As previously mentioned previously, affordable construction spends an enthusiastic applicant’s monthly income to decide whenever they be eligible for advice, however, who determines the amount of money constraints?

New HUD kits and you will revises system money constraints annually, ensuring that reasonable-earnings household found assist. The Service establishes these limits for each and every county otherwise Urban Mathematical City (MSA) in accordance with the town average income (AMI).

What’s Urban area Median Earnings (AMI)?

New HUD uses city average money also referred to as AMI otherwise average family unit members money (MFI) due to the fact a description to choose in the event that people have enough money for rent or get a house. They normally use studies on the American People Questionnaire, that is an analysis conducted by the You.S. Census Bureau. Each year, a separate questionnaire accumulates information that assists government entities decide how guidance money is delivered.

On compiled questionnaire pointers, brand new HUD locates the midpoint in the an excellent region’s money shipment. After that, the Institution breaks this new AMI on other levels considering domestic size:

- Extremely low income: B elow 30% away from AMI

- Really low earnings: B elow 50% regarding AMI

- Lower income: B elow 80% from AMI

- Moderate money: B etween 80% and you can 120% regarding AMI

As they are regionally based, new limits will vary anywhere between towns and cities. Should you want to get a hold of their area’s average money, you can make use of HUD’s money finder otherwise that it much more affiliate-amicable chart.

Once you have calculated in case your earnings is in the limitation diversity for the area, you can attempt leasing or to order affordable construction. To acquire a home, you’ll be able to still need to follow the basic property processes and you can fill out an application in order to a lender. Following that, you might select the right kind of mortgage and you will direction program for the disease.