Erin Kinkade, CFP, ChFC, functions due to the fact a financial coordinator at AAFMAA Wealth Administration & Believe. Erin makes comprehensive financial arrangements to possess armed forces experts and their household.

In addition to the amount of guarantee you really have at home, loan providers consider carefully your credit rating when making approval behavior. Less than perfect credit can also be narrow the range of loan choice you may have to select from.

When you’re shopping for tapping your house collateral, we come up with a summary of loan providers that provide an excellent HELOC to possess less than perfect credit. We shall plus highly recommend selection so you can HELOCs if you wish to use.

How dreadful credit affects an effective HELOC

Good HELOC is actually an effective revolving personal line of credit secure by your home equity. Equity is the difference in your debts on your own home and you can exactly what its well worth. After recognized to have a beneficial HELOC, you might draw on your personal line of credit as needed, therefore only pay focus toward bit you utilize.

Among other variables, lenders imagine fico scores once you submit an application for an effective HELOC. FICO credit ratings, ranging from three hundred so you can 850, will be most popular. payday loans Todd Creek With the FICO scale, a beneficial bad otherwise less than perfect credit score is generally anything less than 580.

- Expenses a higher interest, which will make your personal line of credit more pricey.

- Paying an annual payment or other fees the lending company requires.

- Being tasked a lower life expectancy borrowing limit otherwise quicker good fees terminology.

You have to pay attract with respect to the HELOC you use, however, a higher rate increases the full cost of borrowing. Depending on how far your borrow, the essential difference between a good credit score and you may an adverse you to you may mean purchasing plenty alot more inside notice.

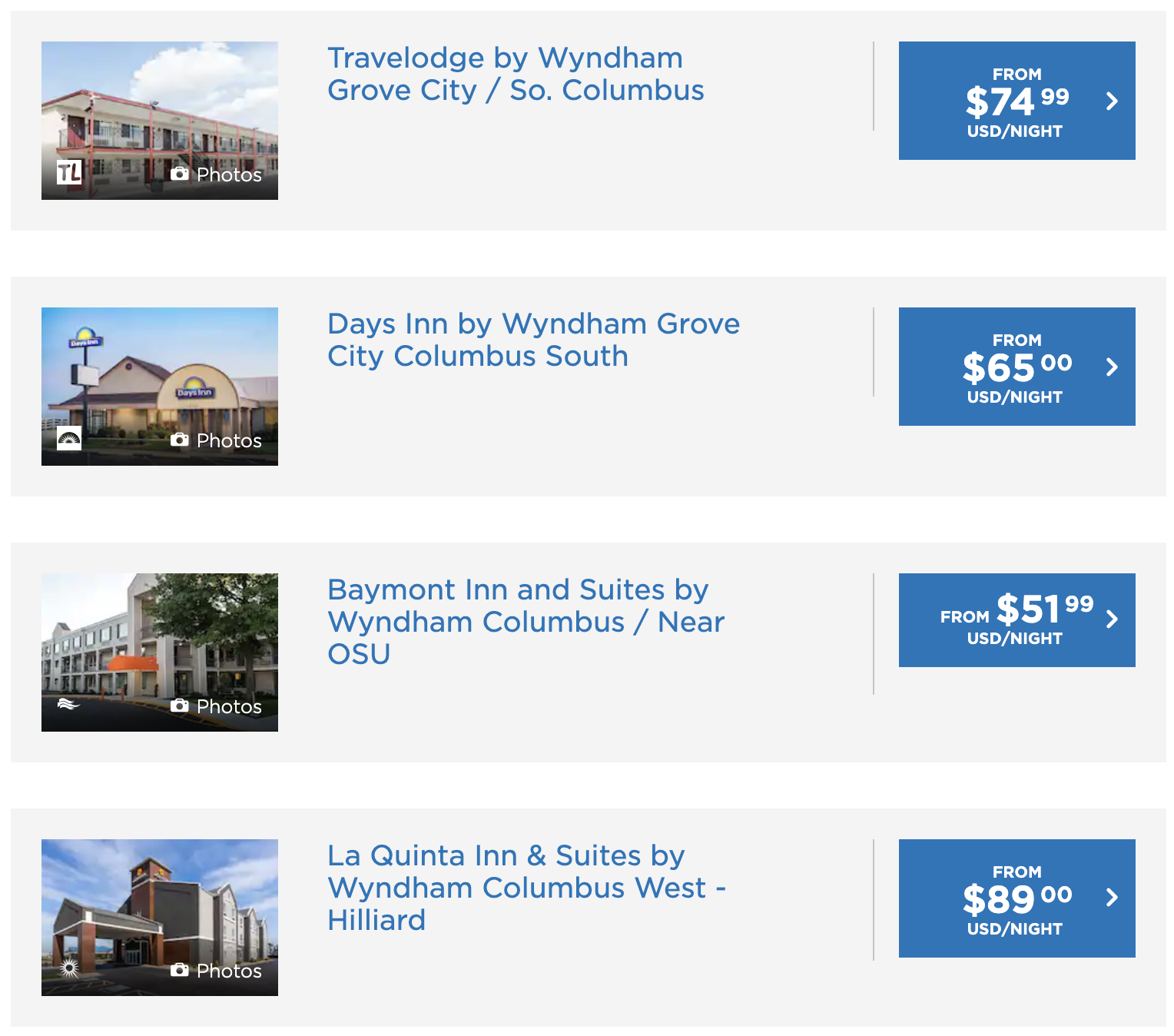

HELOC loan providers getting bad credit

Looking around is important when you need a great HELOC but have less than perfect credit. Its a way to get rid of loan providers you do not meet the requirements getting based on the minimum credit history requirementsparing HELOCs may also make you perspective toward sort of rates and you may words your might be able to get.

- Just how much you might be able to obtain

- Just what rates you could pay

- Whether pricing is repaired otherwise variable

- What fees, or no, may apply

- Exactly how in the future you have access to your line of credit if the recognized

- The length of time you could mark from your personal line of credit and exactly how long the fresh new cost months persists

You are able to want to consider whether or not a good HELOC financial has the benefit of any special benefits, eg an autopay rate disregard. Also a small losing the speed will save you a sizable matter in the end.

Is an instant go through the most useful lenders offering HELOCs to possess less than perfect credit. Click the lender’s identity about desk to read through more info on our accept its HELOC having consumers which have bad credit or zero credit score.

Because you you’ll observe, the minimum credit history to own good HELOC appears to be high than for many signature loans or other sorts of credit.

Generally, credit was firmer because the 2021, while the interest rates has risen considering the Government Reserve elevating pricing. In an effort to avoid an environment much like the 2007 so you’re able to 2009 Great Credit crunch and you will housing crisis, lenders-particularly having very first and you can next mortgages-should make certain they’ve been loaning so you can credible consumers.

Figure Top overall

Contour has the benefit of HELOCs of up to $400,000 in order to borrowers that have fico scores regarding 640 otherwise top, that is noticed fair borrowing into the FICO level. You should check their prices instead of inside your fico scores, however, submitting a full app will result in a challenging credit remove. This can decrease your credit rating and you can apply at your credit history, you is always to see your rating get well within half a year or shortly after while making on the-day costs in the event the installment period begins.